Capital Allowance for Motor Vehicle

This is a standardised deductible allowance in place of Financial Accounting depreciation. 27 August 2015 _____ Page 4 of 22 52 Vehicle a QE for a vehicle licensed for commercial.

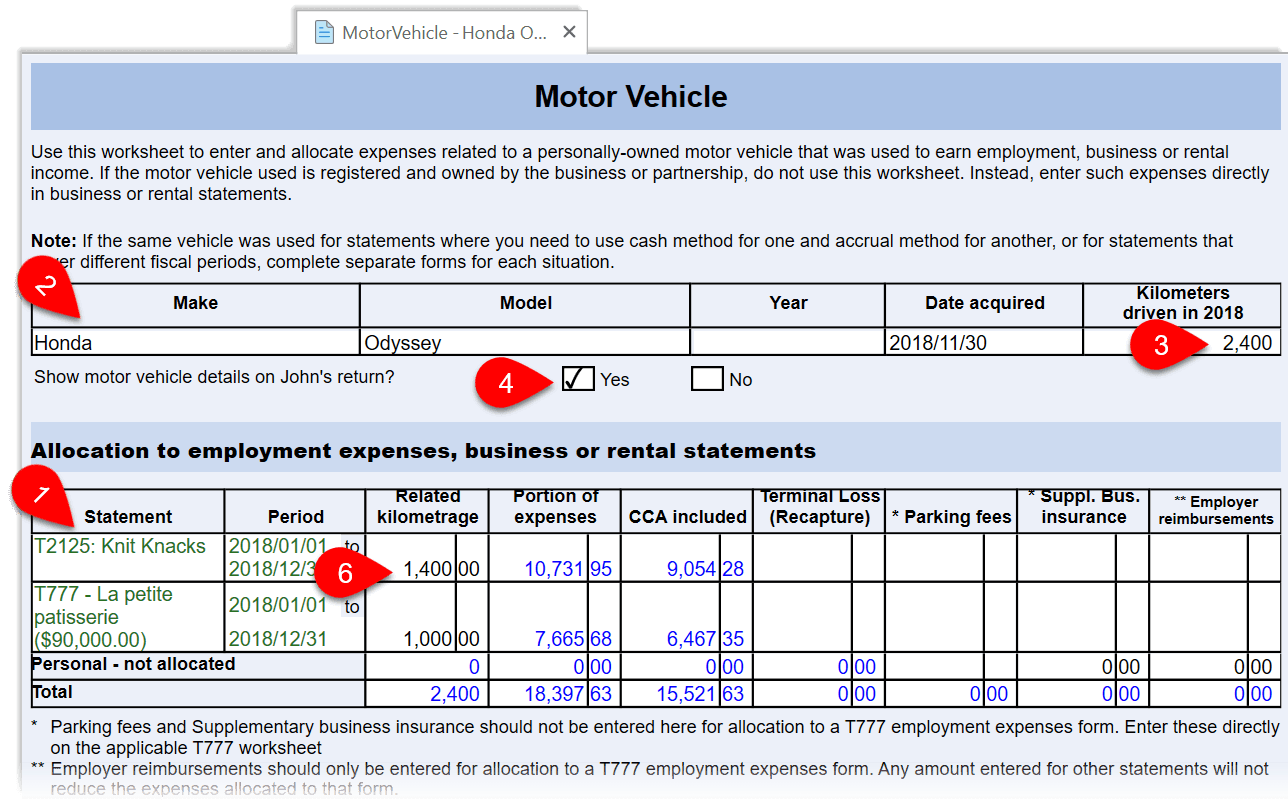

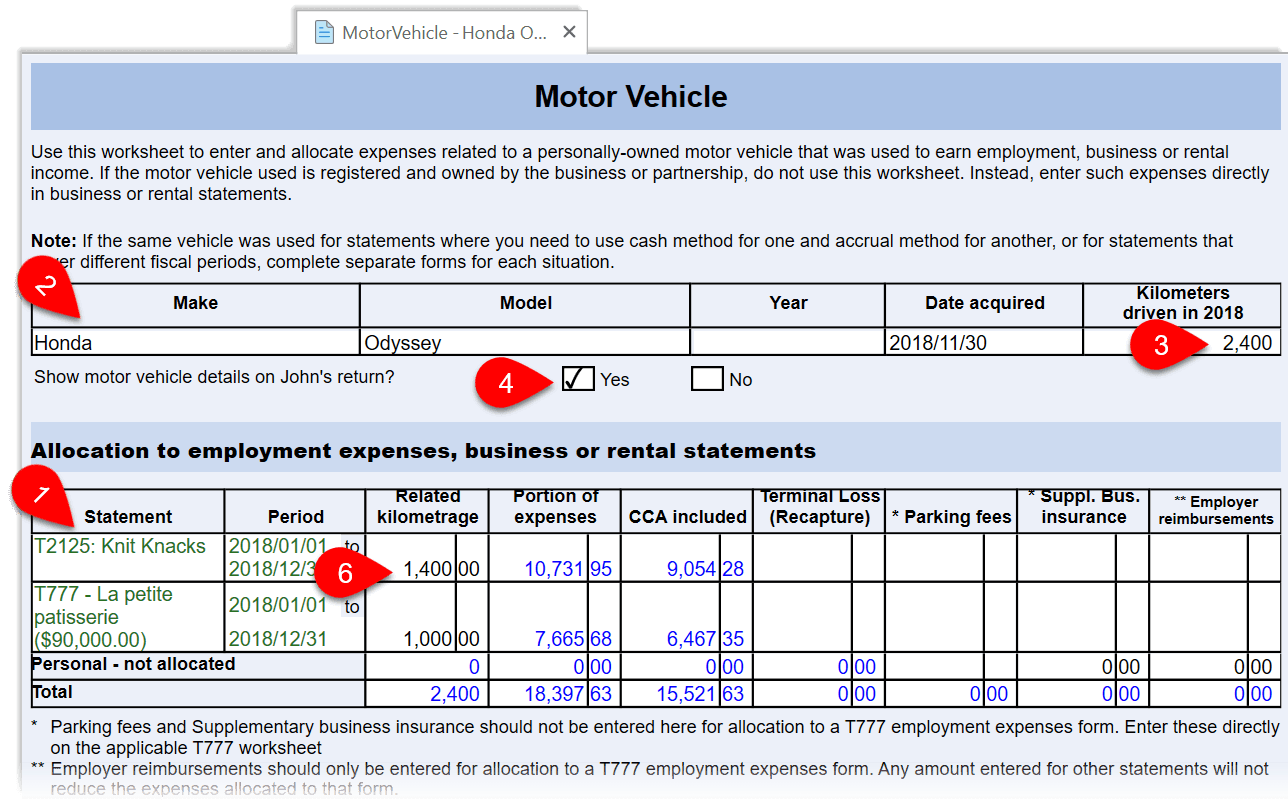

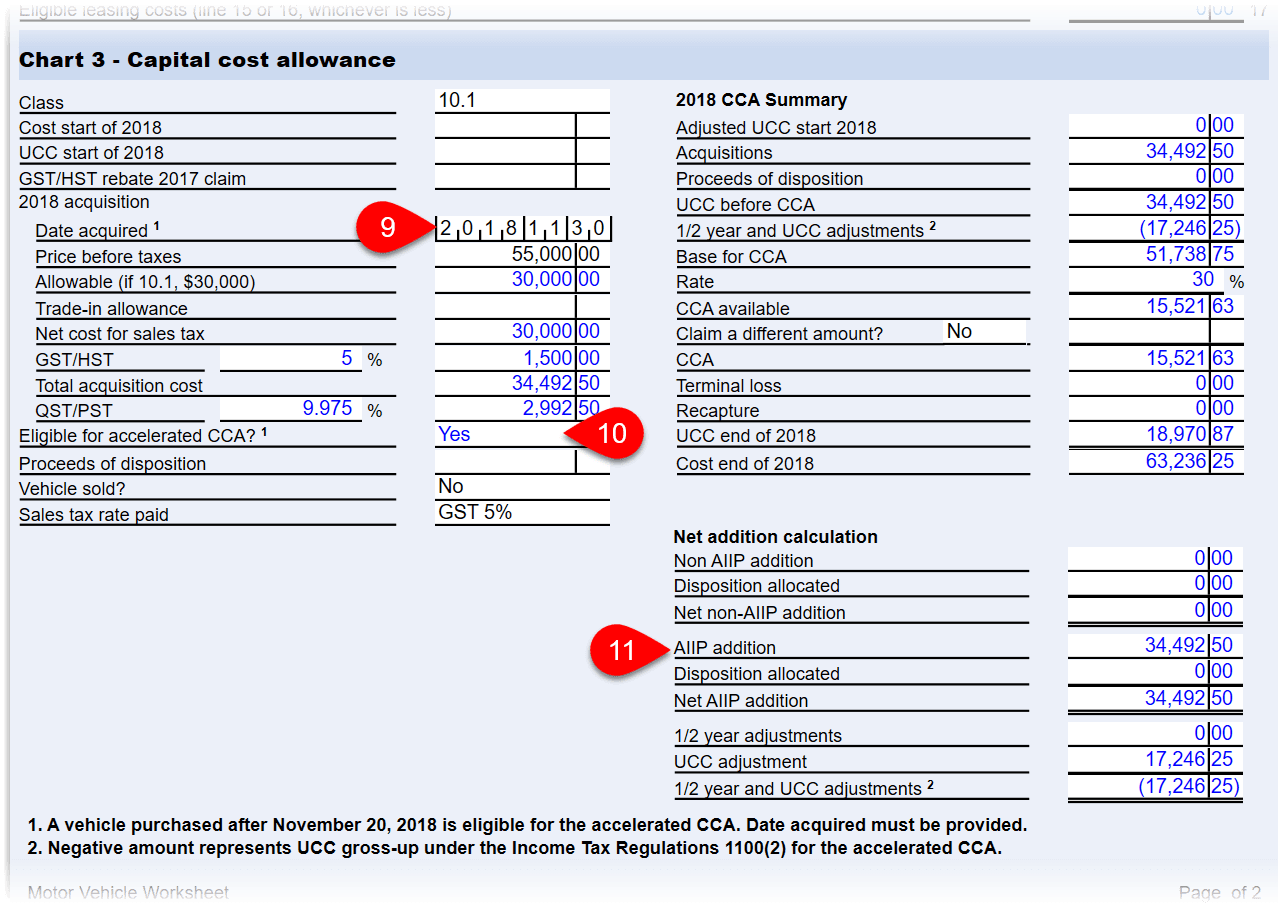

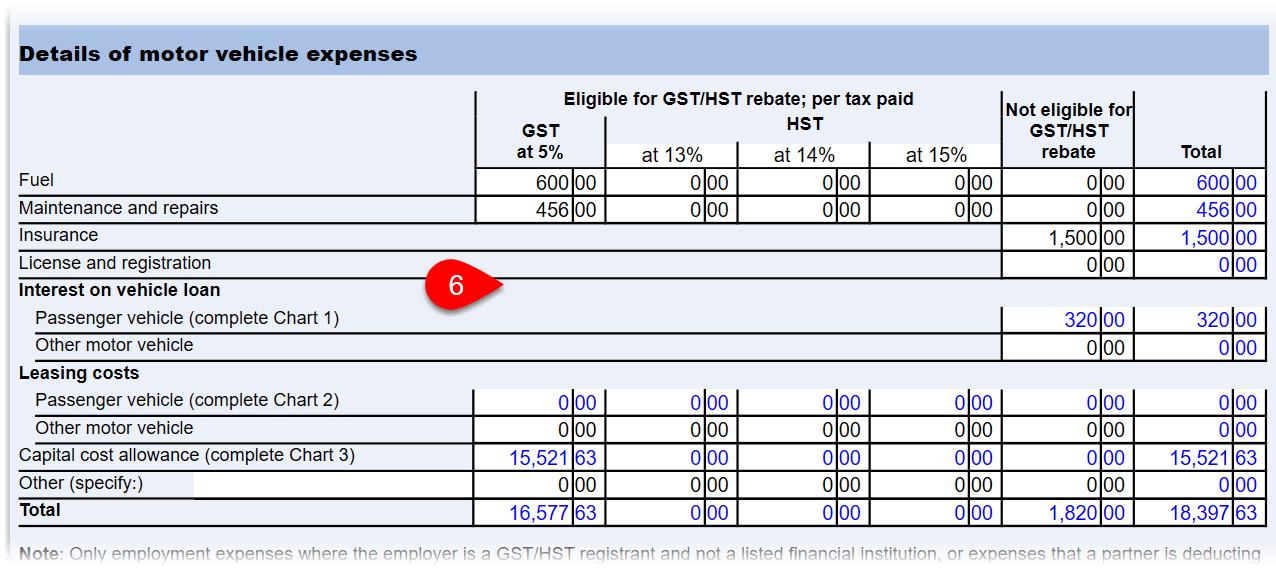

Motor Vehicle Expenses Taxcycle

The annual allowances for private motor vehicles is to be computed on the deemed cost of 3200.

. Motor vehicle will be classified into 2 categories-Commercial. Qualifying expenditure QE QE includes. Transform your vehicle reimbursement program with CarData - See How.

The rate for Initial Allowance and Annual Allowance is 20 respectively. New Jersey State Police. No initial allowance is granted.

Capital Allowance of Motor Vehicle. Disposal of Assets In the event of sale or. Transform your vehicle reimbursement program with CarData - See How.

It is granted to a person who owns depreciable assets and use those assets in. Claim capital allowances so your business pays less tax when you buy assets - equipment fixtures business cars plant and machinery annual investment allowance first year allowances. It is a plant and machinery 64.

152 open jobs for Capital allowances in Piscataway. Search Capital allowances jobs in Piscataway NJ with company ratings salaries. Passenger private vehicle.

Energy efficient equipment. Asset Initial Allowance Annual Allowance. 62015 Date Of Publication.

- cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor vehicles etc. Capital allowances are generally calculated on the net cost of the business asset or premises. It further illustrates how to determine.

Motor Vehicle Drivers Lic. Capital Allowances Plant Machinery Expenditure incurred on or after 4 December 2002 on plant and machinery fixtures and fittings etc may be written off at 125 per annum on a. How are Capital Allowances Calculated.

A train engine cannot be categorised within the meaning of motor vehicles inorder to deduct capital allowances. Ordering a disability placard replacement in New Jersey is generally necessary in the event of a lost stolen or damaged original permit. Commercial vehicle van lorry and bus What is eligible for capital allowance.

Capital allowance is only applicable to business activity and not for individual. The purpose of capital allowance is to give a relief for wear and tear of fixed assets for business. Motor vehicle for Capital Allowance is classified into 2 categories.

The official website of the New Jersey Motor Vehicle Commission. In general disabled motorists can. This would result in a 50 reduction to the capital allowance claimed.

Ad Accurate IRS-compliant non-taxable vehicle reimbursements for each employee. Ad Accurate IRS-compliant non-taxable vehicle reimbursements for each employee. You purchase a motor vehicle for 10000 with CO2 emissions.

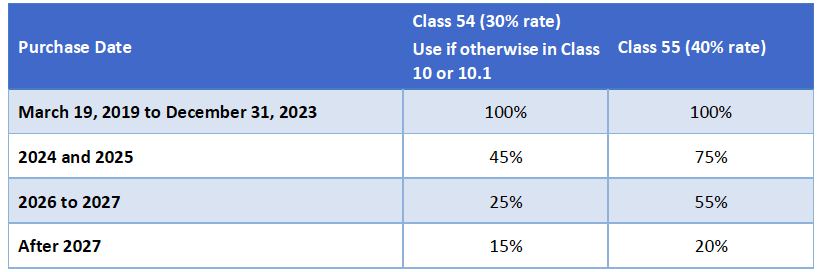

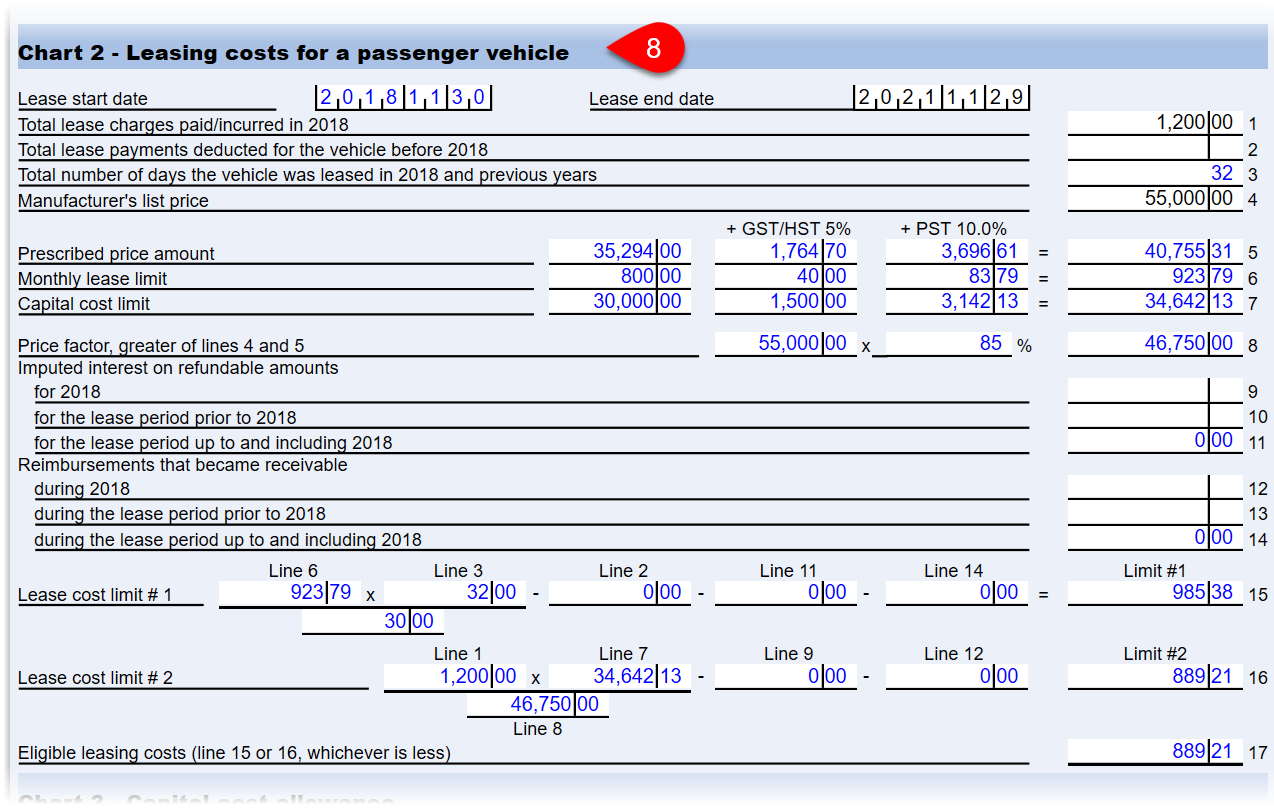

There are different rates available depending on the type of asset. COMPUTATION OF CAPITAL ALLOWANCES Public Ruling No. This example illustrates how to compute CA for non-commercial motor vehicle when Hire Purchase option is being used.

Rates and Fees Refunds TCC TRN FATCA GCT on Government Purchases Direct Banking Direct Funds Transfer. Annual Allowance Plant and Machinery.

Motor Vehicle Expenses Taxcycle

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Motor Vehicle Expenses Taxcycle

Compare Car Iisurance Compare Auto Lease Vs Purchase Car Lease Compare Cars Lease

Comments

Post a Comment